Our Solutions

Managing capital for value, values, and more

At Intentional Asset Management, we do not search for value in “values-focused” investments, nor do we try to retrofit values into purely “value-focused” strategies. We go beyond that binary. Our philosophy is rooted in designing investment products that finance solutions to systemic problems once considered distant, but now undeniably urgent. Clean water, breathable air, resilient food systems, stable energy grids — these are no longer optional aspirations, but essential conditions for economic and social stability.

From this perspective, the case for intentionality is both rational and enduring. Regardless of whether one’s motivation is values-driven or purely economic, the outcome is the same: over time, market prices will reward the firms building solutions to these challenges and penalize those that do not. The alternative is to allocate capital to businesses that ignore or exacerbate systemic risks — an approach that is neither sustainable nor prudent.

We believe that firms intentionally addressing critical systemic problems are better positioned to deliver resilient, long-term returns. This conviction is not dependent on shifting political cycles or investor sentiment, but on the structural reality that global demand for these solutions will only continue to grow.

But intentionality alone is not enough. We invest only in companies that pair this strategic alignment with operational excellence and strong financial foundations. Every investment decision is grounded in rigorous bottom-up fundamental analysis and informed by technical evaluation, ensuring that we select high-quality businesses with disciplined management, resilient earnings, and durable competitive advantages. This discipline ensures that our strategies are not only intentional in focus but also robust in execution.

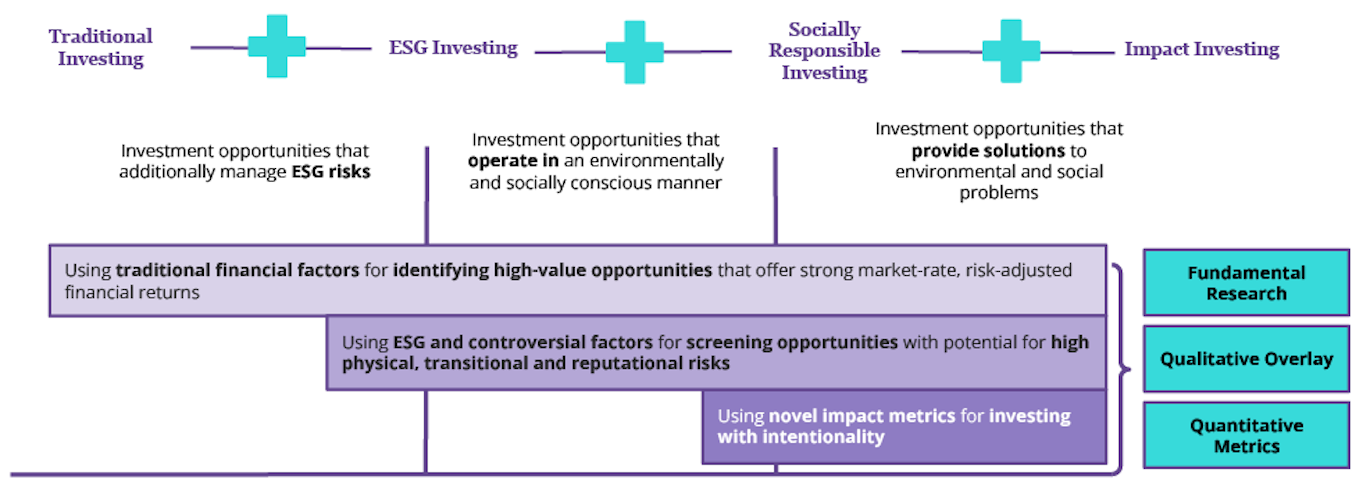

Additionally, we complement this fundamental analysis by also focusing on the following two forms of intentional alignment:

Revenue Alignment – We invest in companies whose products and services directly generate revenues by addressing systemic challenges. These business models are built around market-viable solutions, where impact and profitability reinforce one another.

Operational Alignment – We invest in companies that operate responsibly, embedding environmental and social risk management into their practices. By proactively addressing physical, transition, and reputational risks, these firms demonstrate resilience and durability in an evolving market environment.

This approach strengthens and extends the principles of modern portfolio theory. Diversification remains fundamental, but intentionality adds a forward-looking dimension that considers systemic resilience integral to risk-adjusted returns. By embedding intentionality into portfolio construction, we aim to create strategies that withstand volatility, capture new sources of growth, and deliver financial outcomes that are both sustainable and superior over the long term.

We aim to bring this philosophy to life through two complementary sets of strategies: our targeted private-market funds and our transparent, liquid public-market strategies.

Private Market Funds

Our private market funds are designed to unlock growth and resilience in sectors and regions where traditional capital has often overlooked critical opportunities. These offerings provide investors with access to carefully structured funds that balance strong financial performance with systemic problem-solving.

What sets our approach apart is our proprietary place-based research: by mapping local dynamics, engaging stakeholders, and identifying barriers that have hindered past solutions, we design diversified strategies that channel capital into opportunities positioned for both profitability and meaningful impact.

Caribbean Food Systems Growth Fund

The Caribbean Food Systems Growth (CaribGROW) Fund is our flagship private market strategy, designed to pioneer an innovative, systems-focused equity approach to strengthen food security, expand access to affordable and nutritious food, improve farmer and fisher livelihoods, and increase regional resilience to climate change, while generating economic value for business owners, delivering attractive returns for investors, and complementing the roles of regional financial institutions and development organizations.

Public Market Strategies

Our public market strategies are designed to give investors transparent, liquid exposure to companies and strategies that not only address systemic challenges but also generate resilient returns.

Every portfolio we offer, whether built in-house or curated from intentional partners, reflects rigorous financial analysis and a clear rationale for alignment. This ensures that each strategy is not only positioned for strong fundamentals and market performance, but also for relevance in addressing the structural shifts shaping the global economy.