Great Wealth is Achieved by Those Who Solve Problems

Intentional Asset Management

We are a boutique investment advisory firm that combines institutional investment rigor and human-centered design thinking with a global perspective to help clients achieve not just financial success, but a life aligned with intention.

Our Investment Thesis

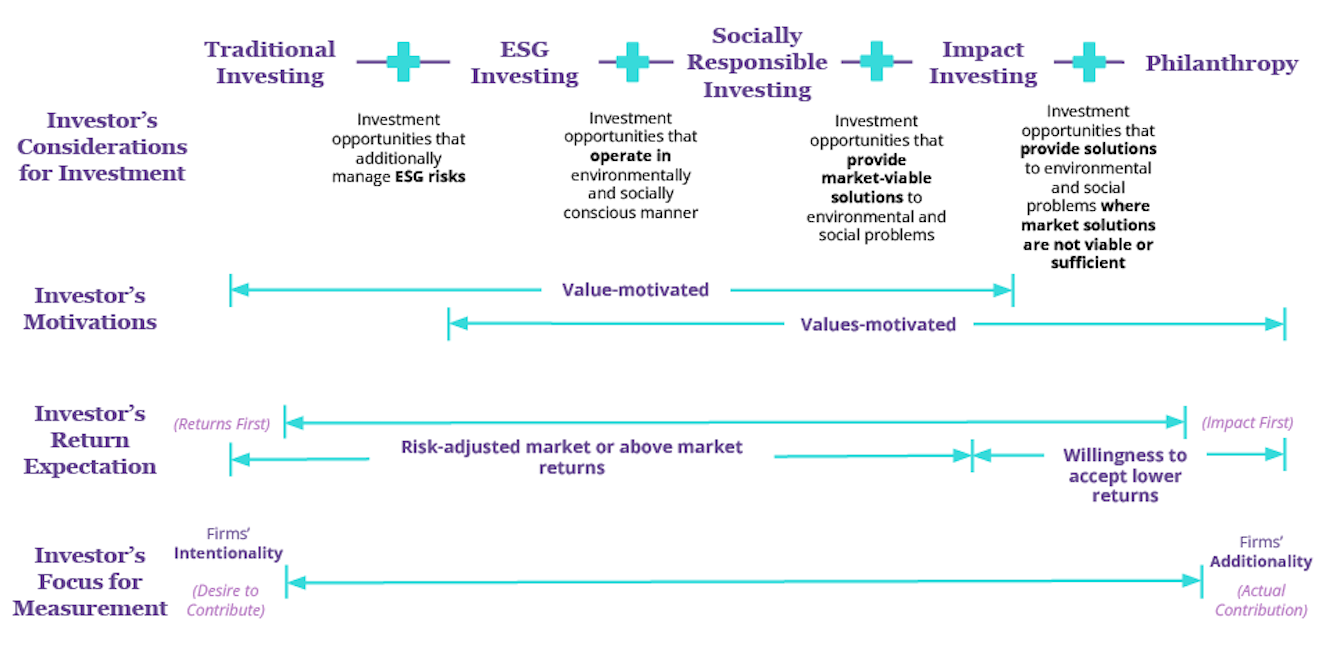

Intentionality is a leading indicator of long-term performance. We define intentionality as a firm’s desire and ability to contribute towards solving specific critical systemic problems of our time. As global markets evolve and the demand for sustainable solutions intensifies, we believe market prices will increasingly reward firms that intentionally build these solutions, making them more likely to outperform those that do not.

Our own intentionality is reflected in where we choose to operate. We specialize in mobilizing private capital toward emerging and frontier markets—regions where a pressing need for investment represents a treasure trove of opportunity for innovation, value creation, and long-term resilience. With public financing insufficient to meet the scale of investment required, we see a compelling economic case for disciplined private capital to lead—capturing value where structural constraints and persistent undervaluation create opportunities for long-term growth.

But intentionality alone is not enough. We invest only in companies that pair this strategic alignment with operational excellence and strong financial foundations. Every investment decision is grounded in rigorous bottom-up fundamental analysis and supported by technical evaluation, ensuring that we select high-quality businesses with durable competitive advantages and disciplined management to drive resilient earnings.

This philosophy guides both our proprietary investment solutions and our advisory engagements. Whether helping investors gain exposure to global opportunities or managing purpose-built strategies in emerging and frontier markets, we apply the same disciplined, research-driven framework to uncover value, manage risk, and deliver resilient, long-term performance.

At Intentional Asset Management, we believe capital should be managed with intention. Our approach combines a systems perspective with a human-centered lens to ensure that both the investment solutions we design and the client experiences we curate are rooted in clarity, discipline, and purpose. Every product, partnership, and portfolio is built to solve real problems, create long-term value, and reflect the goals and intentions of those we serve.

Our Approach

Expertise

Systems Approach

The financial system’s core purpose is to allocate capital efficiently to areas of need and opportunity.

Designing financial solutions

Not all societal challenges can be solved with market-rate capital alone, but where market solutions are viable, financial innovation is essential. By applying a place-based systems approach, we design structures and instruments that better manage risk and unlock opportunity—showing that strong returns and positive impact can go hand in hand.

Beyond constructing the right product, we ensure value creation. Through deep thematic research, rigorous due diligence, and continuous engagement with investee companies, we identify undervalued opportunities and actively shape outcomes, remaining agile, intentional, and aligned with long-term financial objectives.

Active Investment Management

Intentionality requires action.

Behavioral Finance

Markets are aggregates of human behavior.

Markets are rarely driven by fundamentals alone; they are aggregates of companies and individuals, hence, shaped by their leadership decisions, governance practices, cultural biases, and collective sentiment. We focus on a better understanding of how organizations make choices and engage with portfolio companies in an evidence-based manner to strengthen their governance and enhance their long-term value. Additionally, we apply behavioral insights to our technical analysis to anticipate demand and supply shifts, identify sentiment-driven mispricing, and time buying and selling decisions with greater discipline.

Impact Measurement & Management

Intentionality requires accountability.

We provide transparent reporting on both financial and impact performance of our product offerings, ensuring accountability and alignment with systemic goals.

Curating financial relationships

Systems Approach

The financial system’s core purpose is to allocate capital efficiently to areas of need and opportunity.

Whether advising institutions, corporations, families, or individuals, we take a systems perspective on each client’s financial landscape—recognizing that capital decisions are never made in isolation. For institutions and corporations, this means integrating investment strategy with operational, governance, and long-term mission objectives. For families and individuals, it involves aligning investments, cash flow, tax strategy, estate planning, and philanthropy as interconnected elements of a broader financial life. By mapping these dynamics to long-term goals and external realities, we design strategies that create resilience, unlock opportunity, and align capital with intention.

Active Investment Management

Intentionality requires action.

We build strategies that integrate different financial products and exposure types, using institutional-grade research and market insight to tailor them to each client’s risk tolerance, time horizon, and aspirations. Continuous monitoring and adjustments keep portfolios resilient to change while ensuring alignment with long-term goals and personal values.

Behavioral Finance

Markets are aggregates of human behavior.

Money is often an emotional topic, and financial decisions are never made in a vacuum. We use behavioral understanding to anticipate emotional reactions to market volatility, helping clients respond thoughtfully to short-term change while remaining committed to long-term plans. Through clear, empathetic, and proactive communication, we ensure that clients feel secure, informed, and empowered.

Impact Measurement & Management

Intentionality requires accountability.

We give clients visibility into the outcomes of their capital, showing not only financial performance but also how their assets contribute to solving meaningful problems, creating fulfillment beyond returns.

Founding Partner

Intentional Asset Management (IAM), DBA of Intentional Funds LLC, was established by 17 Asset Management (17 AM) in 2022 and formally launched as a dedicated wealth and asset management firm in 2025.

The firm is wholly owned and operated by 17 AM, which also created the 17 Intentional Investment Institute, a non-profit initiative focused on field building, research, and market development to expand the accessibility and effectiveness of intentional investing.