Intentional Thematic Equity Strategies

Through years of research and development, including the design, testing, and live performance tracking of a broad set of UN SDG portfolios, we gained a clear understanding of where intentionality translates most effectively into investable opportunities in public markets.

Our findings made it clear that while every systemic challenge matters, only some can be meaningfully expressed through publicly listed equities that can be organized into strategically diversified portfolios designed to deliver durable returns.

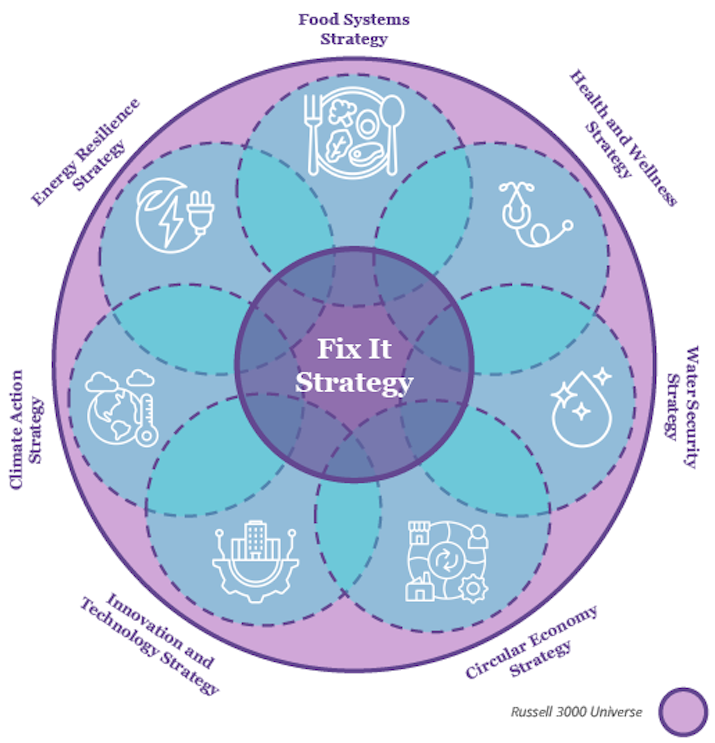

Our framework organizes the investable universe into seven thematic strategies, each focused on a core system essential to a resilient, inclusive, sustainable, and economically durable society. Each portfolio is constructed with 20–40 U.S.-listed equities and provides multi-cap exposure across small, mid, large, and mega-cap companies.

At the center of this framework is our Fix It Strategy, a diversified portfolio that combines the highest-conviction companies from across all seven themes. While each strategy offers targeted thematic exposure, they are built with strategic diversification to ensure resilience across different market environments.

We currently manage select thematic strategies as live models, with the full suite of strategies developed and ready to be activated as our platform expands. This ensures clients can benefit immediately from our most advanced research while maintaining a clear path to broader offerings.

Intentional Water Security Strategy

The Water Security Strategy provides investors targeted exposure to companies at the forefront of securing and managing one of the world’s most vital resources. This actively-managed strategy focuses on four key pillars of water security: Infrastructure, Water Management, Water Quality, and Cybersecurity.

We target businesses building resilient water supply networks, developing smart metering and leak detection technologies, advancing filtration and desalination, and providing cutting-edge cybersecurity solutions to safeguard critical water systems.

Leveraging rigorous thematic research, sector-specific systems analysis, and fundamental financial screening, the strategy seeks to identify high-conviction, U.S.-listed equities with strong growth potential, operational alignment to the water security pillars, and resilient business models. The strategy is designed to capture long-term value from firms solving global water access, efficiency, and security challenges.

Intentional Energy Resilience Strategy

The Energy Strategy provides investors with targeted exposure to companies strengthening the reliability, security, and sustainability of the global energy system. This actively-managed strategy focuses on six key pillars: Energy Supply Diversity & Security, Energy Storage & Grid Resilience, Low-Carbon & Clean Energy Transition, Critical Minerals & Supply Chain Security, Operational & Cyber Resilience, and Energy Efficiency & Demand Management. We target businesses that are leaders in natural gas infrastructure, nuclear energy generation and innovation, rare earth mining and processing, battery storage, smart grid technologies, and digital energy management platforms.

Leveraging rigorous thematic research, sector-specific systems analysis, and fundamental financial screening, the portfolio seeks to identify high-conviction, U.S.-listed equities that seek to deliver competitive, risk-adjusted returns while positioning investors to benefit from the modernization, diversification, and decarbonization of the global energy landscape.

Intentional Innovation and Technology Strategy

The Innovation and Technology Strategy provides investors targeted exposure to companies driving breakthrough advancements that will shape the next generation of global growth. This actively-managed strategy focuses on three pillars of innovation: Disruptive, Transformative, and Inclusive.

We invest in companies building scalable solutions across artificial intelligence, robotics, climate technology, next-generation connectivity, biotechnology, space technology, quantum computing, digital marketing, and digital finance.

Leveraging rigorous thematic research, sector-specific systems analysis, and fundamental financial screening, the portfolio seeks to identify high-conviction, U.S.-listed equities with strong growth potential, operational alignment to the innovation pillars, and resilient business models. The strategy is designed to deliver long-term capital appreciation by capturing the value created by firms solving complex, systemic challenges at scale.

Strategy descriptions are for illustration purposes only and may vary by client.